To zoom in place two fingers on screen and move them apart. To zoom out pinch fingers together.

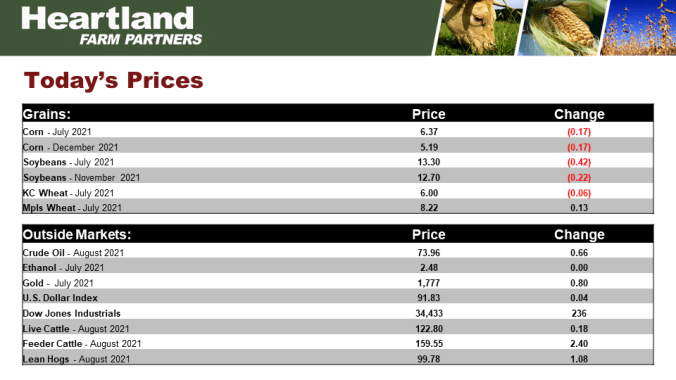

Today’s Prices

Grain markets closed lower today as the Supreme Court reversed a previous court decision which could open up the door for biofuel waivers for small refiners. That was seen as a negative factor.

Weekly Price Summary

Grain Market News

U.S. Acreage Estimates

Next week USDA released its Planted Acreage report and Quarterly Grain Stocks report. This table shows U.S. acreage estimates at different points throughout the year. The bottom line shows the difference between the Prospective Planting Report from March and the Planted Acreage report the comes out on June 30th. When we take the difference, some years Prospective Planting was lower and some years were higher. Our estimate is in yellow which is that acres will be up 4.65 mil from the Prospective Planting report. The average trade guess is expecting a 4.4 mil acre increase. Our expected acreage increase of 4.65 mil would be the largest on record over the past 15 years. Some are concerned that acres could come in larger than the Prospective Planting report. Our answer is probably not because we’re already assuming full planted acreage and a big increase in double crop beans to come up with 229 mil acres. If there was going to be a surprise in next week’s acreage report, it may be that USDA does not raise the acres by 4.6 mil, maybe just a million or two and that would be bullish.

C-B-W Combined Planted Acreage

This year’s acres expected in the Prospective Planting report at about 225 mil acres this year for corn, beans, and wheat. We’re expecting a 4.65 mil acre increase to 229.7 mil acres. If we look at a 12-year average excluding the past 2 big prevent plant years, the June acreage report is typically the largest acreage number of the entire growing season and on average, planted acreage tends to decline a little bit as we head towards the final number. The bottom line when it comes to acreage in next week’s government report, here at Heartland Farm Partners we’re expecting a large increase in acreage, very similar to trade expectation and if there’s going to be a surprise it could be that USDA’s planted acreage does not increase as much as the trade is expecting.

Hogs & Pigs inventory

Yesterday afternoon we got the quarterly Hogs and Pigs report. Hogs and pigs came in pretty close to expectations, down 2.2% from a year ago. Much of this is likely a result that China has rebuilt its hog herd back towards near record levels and the massive exports of U.S. pork to China has likely come to an end and that requires a little bit less of production here in the U.S. Yesterday’s hog and pigs inventory was not considered a surprise for the trade.

Grain Market News

7-Day Observed Precipitation

In the central and eastern corn belt 1-3” of rain has fallen but unfortunately good rains did not fall in the northwestern belt and northern Plains. Anything in blue are areas that are likely to see crop conditions slip lower next week’s update from USDA. The good rains, 1-3” and isolated more in the heart of the belt, parts of IA, IL, and IN are likely to allow crop conditions overall as a U.S. average to improve slightly.

NWS Active Alerts

There’s extreme heat in the Pacific northwest which affecting white wheat as well as durum wheat. And then flood watches and flood warnings across the central U.S. and part of the heart of the U.S. corn and bean belt. We’ll have to monitor to see if that causes any major issues. Typically, rainfall will benefit crops more than flooding would hurt the crops over the entire U.S. but we’ll have to see if there is widespread flooding come next week.

7-Day Precipitation Forecast

More heavy rains in the areas where they don’t need it from MO, IL, and into IN. But there are also come good rains forecasted in IA and some of that could spill over into southern MN and NE. So there are still some beneficial rains forecasted over the next couple of days. Unfortunately, the forecast is not calling for much in the way of rain in the northern Plains.

6-10 and 8-14 Day Forecast

The 6-10 and 8-14 day forecast looks very similar to what we’ve been discussing all week this week. There’s a dividing line with warmer, drier conditions to the northwest, cooler wetter conditions to the southeast. That looks like it could continue for the next two weeks into early July.

Predicted Soil Moisture Anomaly

We can see evidence of that dividing line when look at the predicted soil moisture change over the next two weeks. Soil moisture is expected to decline in the north belt and northern Plains and increase in the southern and eastern belt.

December Corn Chart

Corn prices have been extremely volatile. Over $1 move up and down. We’ve seen the market test the upper end of the range twice and now we’re testing the lower end of the range for the third time and we expect more of this extremely volatile trade in the months to come especially as we move through July. Currently prices are near the lower end of the range with technical indicators oversold. Even though we’re not at the bottom yet, this is not a place to be making sales as we get close to chart support and technicals close to oversold.

November Soybean Chart

Soybean prices have also seen extreme volatility over the past 2-3 months. We expect more of that volatility in the weeks to come. Right now prices are getting closer to the lower end of the range with technical indicators close to getting oversold. Even though this market could slip lower in the near term, this is not a place to be making sales on beans. We’ll wait. We believe it is likely we’ll get additional weather scares as we move through July.

July KC Wheat Chart

Wheat prices have also seen very volatile trade over the past 2-3 months. Prices right now, although we’re above the lows established early in March, prices are still closer to the lower end of the range than they are to the upper end of the range. We’ll be patient and wait for the next bounce before advising any additional wheat sales.

To return to the previous page on your mobile device, click the back arrow in the bottom tool bar.