Today’s Prices

Grain markets finished higher today with threatening Argentina weather providing most of the buying.

Grain Market News

South American Precipitation Forecast

Today’s forecast has removed some of the rain for Argentina in the first week of the forecast.

That was seen as somewhat friendly, but out in the second week the forecast looks wetter.

The dryer forecast combined with heat was the primary reason behind today’s rally.

Temperature Anomaly

The temperature forecast for net week remains above normal for virtually all of Argentina’s growing regions.

Crop Critical Weather Events

Most of central and northern Brazil is in very good shape.

Southern Brazil, Paraguay, and Uruguay is questionable.

Argentina is where most of the drought conditions are in place, especially in central and southern areas.

Grain Market News

U.S. Hogs and Pigs Inventory

The hog and pig inventory shows that it is down 1.8% from last year.

That would indicate less feed demand than a year ago.

Its worth noting that farrowing intentions are up, first quarter .9%, second quarter up .5%, and third quarter up .7%.

This is due to the breeding herd being up a half percent from a year ago.

Quarterly Sows Farrowed and Intentions

Farrowing intentions in 2023 is expected to be up first quarter from last year and second quarter up as well.

The peak of farrowing intentions took place in 2019-2020, that was during and after China had a massive outbreak of African Swine Fever which reduced theirs by 50%.

This year we should start to see farrowing intentions improve.

U.S. Cattle on Feed

Cattle on feed as of December 1st, down 2.6% from a year ago.

So clearly it is down but not down anywhere close to the 7.3% reduction in feed use that USDA is projecting.

Animal Production

Beef production would be down 7.5% in 2023, pork production up 1%, broiler production up 1.8%, and turkey production up 6.5%.

Total red meat and poultry production is expected to be down .7%.

Egg production is projected to be up 4.8% in 2023 and milk production up 1.1%.

December Corn Chart

Corn prices up again today, 6.83 is the high.

This pulls prices right up to the downtrend line that’s drawn off the October and November highs.

Technical indicators are extremely overbought, but this doesn’t mean we can’t go higher.

Major chart support is around 6.55, 25-30 cents below today.

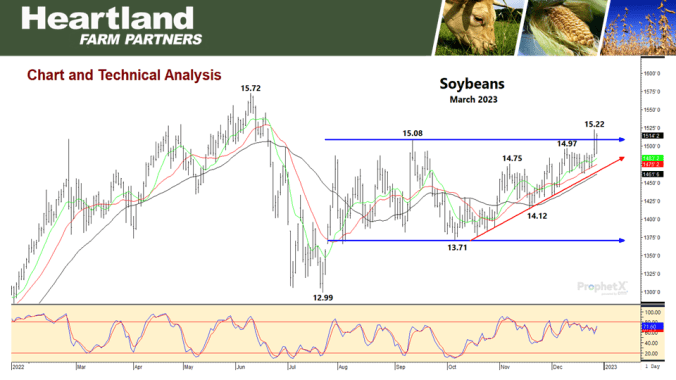

November Soybean Chart

Soybean prices up today but unable to take out yesterday’s high at 15.22.

The overall trend is still pointed upward but we believe beans are also near the upper end.

Yesterday’s high at 15.22 is overhead resistance.

Chart support at 14.75.

December KC Wheat Chart

Wheat prices did rally today but similar to soybeans we were unable to take out yesterday high at 8.94.

Overhead resistance is at 8.94, 12 cents above todays close.

Chart support is at 8.60.

Questions or Comments