Today’s Prices

Grain markets finished lower across the board today, outside markets were very negative.

Grain Market News

South American Precipitation Forecast

Argentina continues to have below normal precipitation, and some extends northward and eastward into portions of Uruguay, Paraguay, and southern Brazil.

The second week does show some better rains for Argentina but there could still be some pockets in other areas of Paraguay, Uruguay, and extreme southern Brazil.

The bulk of Brazil looks to have good rains in week 1 and week 2.

Temperature Anomaly

Temperatures mostly favorable in Brazil, some areas to the north a little cooler and some in the south little warmer.

In Argentina where there is dry conditions, temperatures look to be above to much above normal over the next week.

Observed Surface High Temps

Argentina’s growing region has temperatures yesterday in the mid and upper 90s across almost all of Argentina.

Those temperatures may be even hotter this week with 100s very possible.

Monday’s High Temperatures

You can see if we highlight Argentina’s growing region, mid upper 90s and a lot of 100s are likely today.

We could see on and off 90s and low 100s right through the end of the week.

NOAA

Anything negative is below average or cooler than normal ocean water and anything a plus number, above zero would be warmer than normal.

Below normal is considered La Nina and above normal is El Nino.

The national weather service is predicting that La Nina conditions are peaking now and by the time we get into March or early April, sea surface temperatures in the equatorial pacific ocean could be back to normal.

Grain Market News

Corn: Weekly Export Inspections

Corn inspections did rally nicely up to 20.6 million bushels.

That’s good news but keep in mind we need 50 million bushels per week to reach the USDA forecast.

Our year-to-date exports are down 32.7%, USDA is projecting exports to be down 13%.

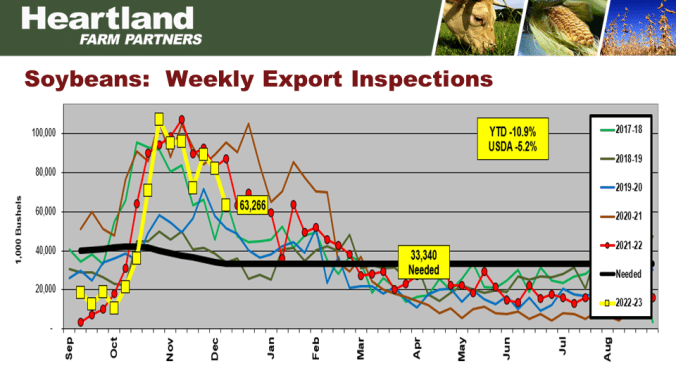

Soybean: Weekly Export Inspections

Soybean inspections came in at 63 million bushels, that’s down from over 80 million bushels last week and also the lowest number over the last 8 weeks.

It is above the level needed.

Our first 3 months of our marketing year, soybeans are 10.9% below the year ago level, USDA is projecting exports to be down 5%.

Wheat: Weekly Export Inspections

Wheat at 12.296 bushels, that’s the best number in about 8 weeks.

But still just a little shy of the USDA number needed.

Our year-to-date inspections after half the year is behind us is down 2.2% with USDA projecting it to be down 3.1%.

December Corn Chart

Corn prices very disappointing late last week and the market has been trying to creep upward through November and last week markets fell.

Technical indicators are getting close to the oversold range.

Off the highs posted in October the market is in a downtrend.

November Soybean Chart

Soybean prices quite different off the October lows they have been in an uptrend.

We did fall late last week but soybean prices have been holding in pretty well.

If the red line holds, that’s good news.

December KC Wheat Chart

Wheat prices down sharply today making a new low for the move.

Chart and technical selling certainly a feature today.

We are getting very close to the lows we seen last summer in the 8.10-8.40 range.

Questions or Comments